April 25, 2025, Washington DC

The International Monetary Fund (IMF) urged sub-Saharan African countries to strengthen domestic revenue collection to shield themselves from the global economic downturn and avoid falling deeper into debt.

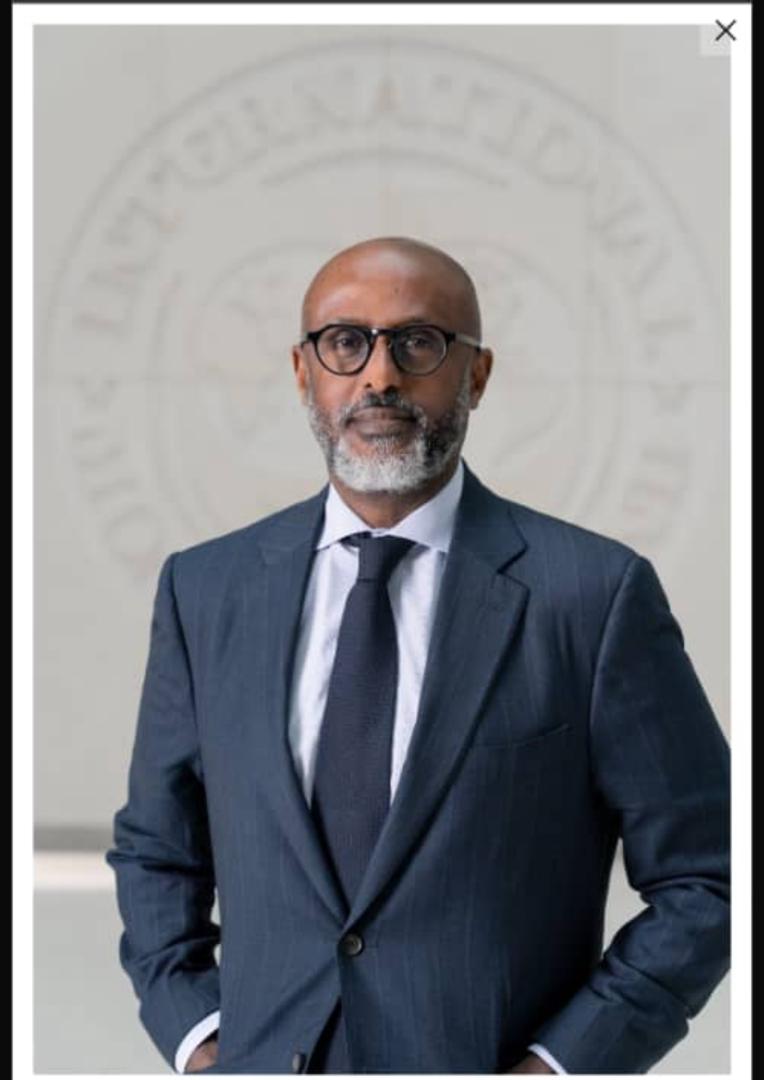

Abebe Aemro Selassie, the IMF’s Director for Africa, emphasized that the region can no longer depend on debt-financed growth as a sustainable strategy. His comments come as the IMF revised its 2024 growth forecast for sub-Saharan Africa downward to 3.8% from an earlier projection of 4.2% citing risks from global trade tensions and tighter financing conditions.

Debt-Financed Growth No Longer Viable

With rising borrowing costs and reduced access to international capital markets, Selassie stressed that African governments must find affordable and stable sources of funding to support economic expansion and social programs.

“You need to find domestic resources to accelerate growth and meet social spending needs,” he said, calling for policies that enhance tax collection and curb wasteful expenditures.

IMF reported that the region’s average debt-to-GDP ratio reached at least 60% last year, with some countries, like Kenya, facing even higher debt burdens.

Global Trade Tensions Add Pressure

The IMF’s revised outlook also reflects concerns over U.S. trade policies particularly after former President Donald Trump announced tariffs on multiple trading partners, triggering market volatility. This has made it harder for sub-Saharan African nations to tap into frontier capital markets, where investors are increasingly risk-averse.

While some economies in the region continue to grow, Selassie warned that without structural reforms, debt distress could undermine long-term stability.

Emebet Asefa,

Correspondent | Addis Ababa, Ethiopia